In a recent series of investor meetings in the US, Infosys’ CFO and Financial Controller shared upbeat updates on the company’s progress and future outlook. According to BofA, Infosys (NS:) is doing well for the first quarter of FY24, thanks to the growth of several key deals initiated in March.

Despite recent underwhelming performances by other software and digital firms, Infosys management believes their cautious assumptions around discretionary spending will protect them from additional pressures. However, the broader demand environment remains conservative, with a focus on cost-cutting projects.

Offer: Click here and discover the power of InvestingPro! Effortlessly access accurate stock values and detailed financial health results using over 100 parameters. Get our limited time 10% discount now and make informed investment decisions with ease!

Infosys is establishing itself as a leader in AI and generative AI services, earning top rankings from seven industry analysts. It is one of the first IT services companies globally to receive certification for its AI management systems, which promote responsible AI practices and regulatory compliance.

These credentials are expected to position Infosys as a significant player in the expanding AI services market. Interestingly, Infosys has not seen a decline in deal prices due to expected AI-driven productivity gains, and vendor pricing aggression remains low despite wage inflation and foreign exchange trends.

BofA has set a price target (PO) on Infosys at INR 1,785 (ADR: US$21.5), based on a target price-to-earnings (P/E) ratio of 25x for the 12 months ending March 2026. This the target is about 10% below the sector leader’s multiple, in line with the average trading discount over the past three years. Compared to its historical performance, this target multiple represents a premium of 10% over Infosys’ five-year average P/E multiple.

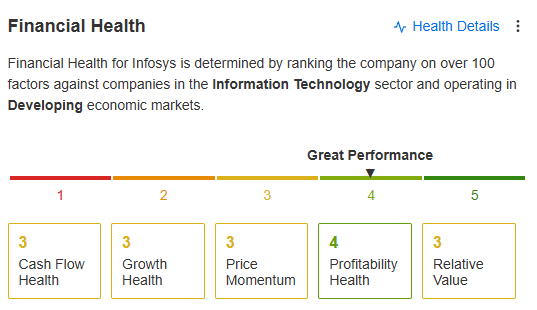

Image source: InvestingPro+

There is no doubt that it is an investment-grade stock as the financial health score on InvestingPro is 4 out of 5, which is commendable. Not many stocks are able to score this high. This result is given after analyzing over 100 parameters on the fundamental front, making it a piece of cake for investors to know the financial strength of the company without having to dive deep into the financials.

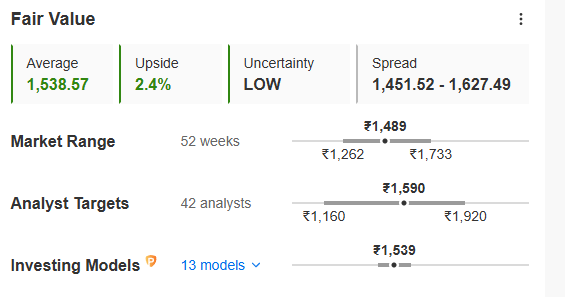

Image description: InvestignPro+

On the valuation front, the fair value feature assesses an appropriate price of INR 1,538, presenting an upside potential of INR 2.4% from the CMP of INR 1,488.9. This is lower than what BofA is estimating, but the bottom line is that the bots are bullish on the counter.

In fact, the average analyst target is also higher than CMP, at INR 1,590. So it is clear that the stock is loved by many, but the valuation gap is not enough to take risks. Therefore, waiting for a dip to make an entry may be a better idea.

Infosys aims to maintain its robust free cash flow (FCF) growth, which stood at a robust 14% year-on-year in FY24, through FY25. The company expects its FCF growth to continue to outpace revenue and earnings growth, although it admits to a 4%-5% lower FCF/sales ratio compared to peers. This is due to Infosys’ accounting treatment of financial income from long-term investments.

Looking ahead, BofA predicts a return to revenue growth for Infosys in FY26, driven by increased spending on regulatory technology by banks to meet Basel III requirements and deferred SAP upgrades. Given the stock’s poor performance over the past two years, its valuation is highly sensitive to these upside prospects. The earnings outlook for FY25 is close to flat, but Infosys is expected to benefit from growing AI-led demand.

You can check the financial health score of any stock along with other features like fair value, ProTips, etc., all in InvestingPro. Click here and get InvestingPro now at a deeply discounted price, all thanks to the limited time sale of 10% off! Hurry and get your offer today!

Read more: Unlocking investment potential through fair value

X (formerly, Twitter) – Aayush Khanna

#Stock #Poised #Growth #FourthQuarter #Momentum #Leadership #Fuel #Optimism #Investing.com

Image Source : www.investing.com